Online greeting card and gift company, Moonpig, is planning London stock market float after surge in lockdown sales.

Moonpig have announced plans for a potential listing on the London Stock Market which could value the private equity backed company at over £1 billion.

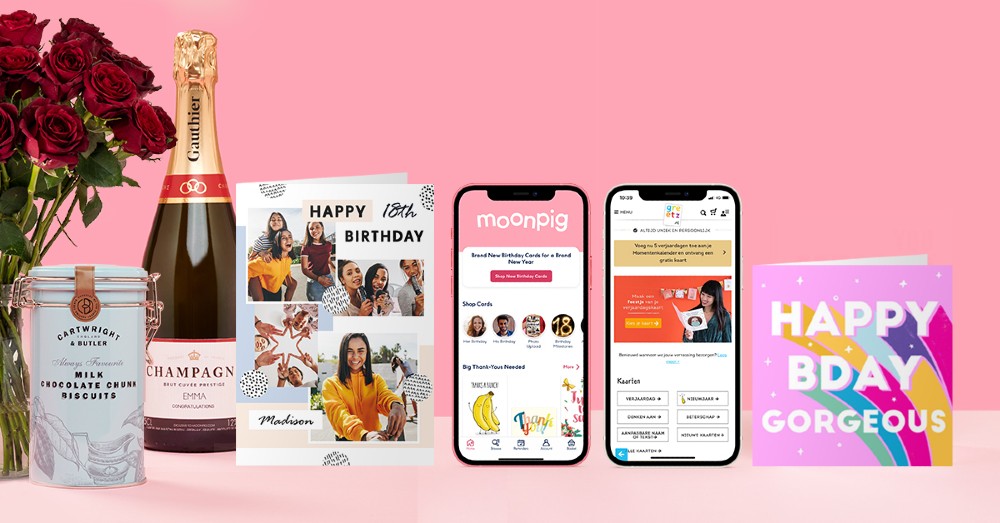

The company which operates as Moonpig in Britain and Greetz in the Netherlands, is targeting a free float of at least 25%. Citigroup, J.P. Morgan, HSBC, Numis and Jefferies have been engaged to manage the share offering should it proceed.

The IPO is being considered to raise the profile of the Company and provide the opportunity for further growth.

In the financial year ending April 2020, the company generated revenues of £173 million and a further £156 million in the half-year to October 2020, the company said. With over 12 million active customers as the end of October 2020, and strong customer retention, the company wants to capitalize on its technology and customer experience.

Nickyl Raithatha, Chief Executive Officer of Moonpig Group, said, “Moonpig Group’s mission is to create moments that matter, helping people to connect by sharing meaningful cards and gifts. This is more important now than perhaps ever before. We have built a technology platform that harnesses data-science and AI at every point of our customers’ journey, making it as effortless as possible for them to be as thoughtful as possible. The combination of our extensive range of personalised cards, curated gifts, high-speed logistics, and unique predictive insights into gifting intent, helps our 12 million loyal customers to remember, choose, and create the perfect card and gift for every occasion. We are confident that Moonpig Group will continue to make gifting even more effortless for millions of people across the UK and internationally, and as the leaders of the accelerating shift to online now is the perfect time for us to bring the company to the public market.â€